The insurance industry seems to agree on one thing for 2024: Massive rate increases are behind us. While clients who have experienced major premium hikes in the last several years should welcome this news, they will not see rate decreases anytime soon. In fact, rates will likely continue to rise at a more reasonable level as the industry suffers from underwriting losses and firmly believes it is charging an inadequate price for many risks.

Over the last several years, the story has been the same and will not change in 2024 – extreme climate change, out-sized cybercrime activity, lack of tort reform, and social inflation continue to destabilize the marketplace, pushing insurers to strive for rate adequacy. Deloitte’s 2024 Global Insurance Outlook may have said it best: Insurers act as “society’s ‘financial safety net’.”1 To remain profitable, insurers have to protect against catastrophic risk and that often means charging more.

However, rates are not the only way in which insurers are seeking protection. According to Deloitte’s report, “…more insurers are realizing they have a bigger role to play in helping prevent risk, mitigating loss severity, and closing life and non-life protection gaps in global markets, especially in the face of the growing number of what appear to be financially unsupportable risks.”1

As policies renew in 2024, clients will receive more requests for loss control measures and will be given little time to do so. In the past, insurance companies accepted the risk and gave the client a reasonable time frame to get the requirements completed. No more. If loss control measures are not in place before binding, insurance companies may not agree to cover the risk. Or if measures are not satisfied within 30 days, they may take a hard line and send notice to cancel the policy.

Why Pricing is Leveling Out

There is some good news in the premium pricing front: reinsurance renewals are looking to be more stable in 2024 and investment returns have been positive.

Reinsurance is often purchased by insurance companies to pass off some of the risk, so one company will not have to bear the burden of a major event alone. Companies like SwissRe, MunichRe, Lloyd’s of London, and Berkshire Hathaway all sell reinsurance to insurance companies. For example, Travelers or Chubb may retain the first $50M of every risk and purchase reinsurance for anything above $50M. The cost for that reinsurance is then passed along to the client.

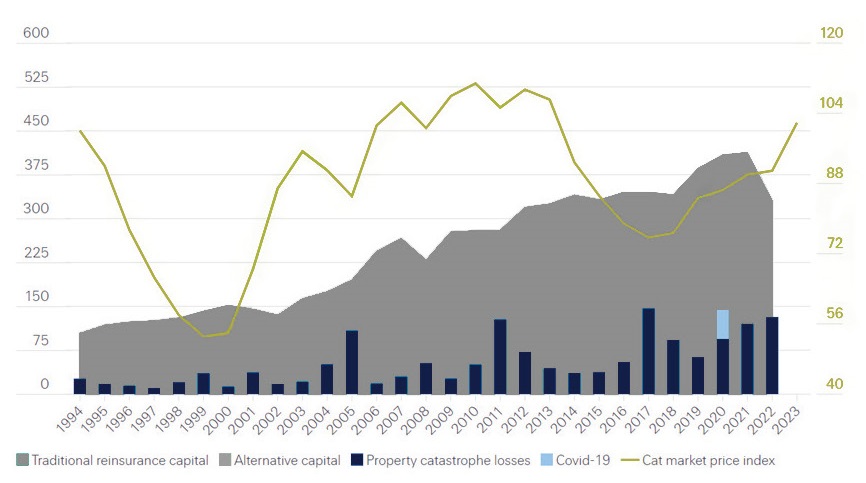

As you can see from the chart below, the cost of reinsurance has skyrocketed over the past several years, which is one of the reasons premium increases have been so substantial.

Reinsurance capital versus price cycle 1994 – 2022

LHS: USD bn, RHS: 1994 = 100.

Source: Swiss Re Institute

However, 2024 looks to be a better year for reinsurance. According to The Insurance Journal, reinsurance renewals are said to be, “‘stable,’ ‘predictable,’ ‘orderly,’ ‘calmer,’ ‘disciplined,’ with ‘increased appetites’ and a return to supply/demand balance.”2 This tone, which is different from last year, should translate into a more stable market where price increases are less than years past.

In addition to reinsurance rates pointing toward less volatile premiums, investment returns have been positive. Increases in interest rates have benefited insurance company portfolios and, ultimately, their bottom line. According to AM Best, “A notable tailwind for commercial insurers… is the significant strengthening of yield for insurers’ fixed income securities portfolios as free cash flows and maturing fixed income portfolios continue to roll over into sharply higher interest rate bearing bonds. Over the past decade, insurers have had to generate more substantial underwriting profits to offset the impact of persistently low interest rates.”3 As an example, $1B invested at 5%, instead of 2%, earns an additional $30M for no risk. For large insurers with a portfolio of $100B or more, the difference in investment returns is significant.

January 1, 2023 Reinsurance Renewals: Impact on Insurance Rates

Pricing is only a part of the story. While we expect pricing to be stable, insurers will be looking to mitigate risk. By taking risk off their balance sheet, they protect shareholder value while not putting forth the same massive rate increases seen over the past several years.

Client should expect smaller pricing increases, but more restrictive terms. The two classes of insurance that have seen the largest increases in the last several years are Property and Cyber. For real estate, expect higher deductibles for interior water damage claims, and caps on certain losses. For cyber policies, clients should expect lower limits, higher deductibles, required security protection and less appetite to use the client’s attorney and forensics firm. In some cases, insurers may run vulnerability tests before agreeing to cyber terms. If the test comes back with recommendations, client may need to remedy those before coverage will be put in place.

The Effects of Weather

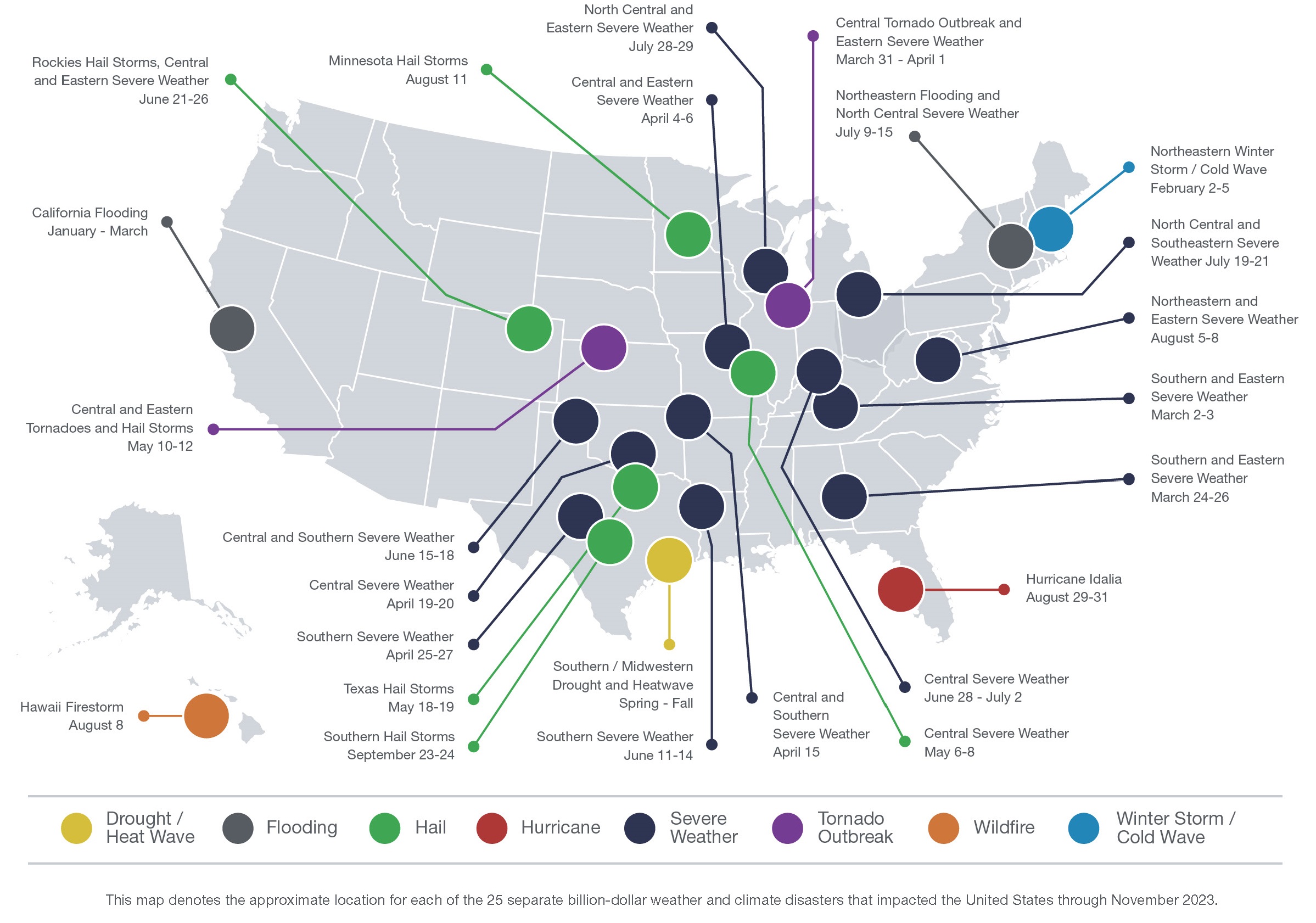

Weather continues to be an issue for insurers. From January to November 2023, there were 23 events costing insurers $1B or more. The below graph lays out each event via the NOAA’s interactive listing by type of catastrophe (i.e., flood, earthquake, storm, wildfire).

U.S. 2023 Billion-Dollar Weather and Climate Disasters

Source: National Centers for Environmental Information NOAA

Turning to the E&S Market

To mitigate some of the challenges associated with unsettled weather, insurance companies will be placing risks in the excess and surplus markets. Unlike the admitted market, which is highly regulated, offers protections for both insurers and insureds, but requires rates be approved by the state insurance commissioner, the excess and surplus (E&S) market allows insurers greater flexibility and less regulation.

As a result, many of the traditionally admitted insurance companies are setting up excess and surplus lines companies to insure higher risks so they can adjust rates and terms quicker, charge higher rates and limit coverage without insurance regulators’ approval. This is key to charging a rate the insurance company believes is adequate for the risk. It would not be surprising if E&S will be the standard for property owners in California, Florida, and Texas. Coastal properties, in particular, are unlikely to get admitted offers.

In AM Best’s Market Segment Outlook, the following is noted: “Admitted carriers appear to be exercising caution in both property and liability lines, including significant numbers of commercial insured to seek coverage in the E&S marketplace….Among lines being side-stepped by admitted carriers and finding their way to E&S carriers are commercial auto, D&O, Cyber as well as catastrophe-exposed property and other high volatility coverage.”3

What to Expect in Personal Lines

No overview or report about the insurance marketplace is complete without a closer examination of the personal lines marketplace. AM Best’s opening sentence to their 2024 Market Segment Report sums up the state of the market: “AM Best’s outlook for the US personal lines segment remains at Negative.”4

There is no geographic area that is safe from the losses. Hawaiian fires, Southeastern and Southwestern wind events, Northeast freezing, Midwest tornadoes, West Coast flooding and fires all contribute toward higher costs for all. In some cases, insurers have decided to leave states because they could not get an adequate rate to charge for the risk. In June 2023, Allstate announced they would no longer offer new policies in California. According to the New York Times, the reasons cited were rapidly growing catastrophe exposure, state regulation, and inflation, which led to higher loss costs.5

This is a good example of how carriers are not looking to mitigate risk but take risk off the balance sheet. Think about this: California is largest economy in the USA by GDP per capita and would be considered top 10 in the world, and one of the largest insurance companies in the country decided to stop offering new policies there. Allstate would be an outlier if it were the only company to make that decision, but State Farm also made the same announcement and others continue to dial back risk in the state.

In 2021, Evan Greenberg, CEO of Chubb LTD, said they were limiting their risk in areas of California that are “both highly exposed, and even moderately exposure to wildfire”. He continued by saying that Chubb could not “adequately price for the risk, and not by a small amount…..Someone else will have the pleasure of writing that business, unfortunately.”6

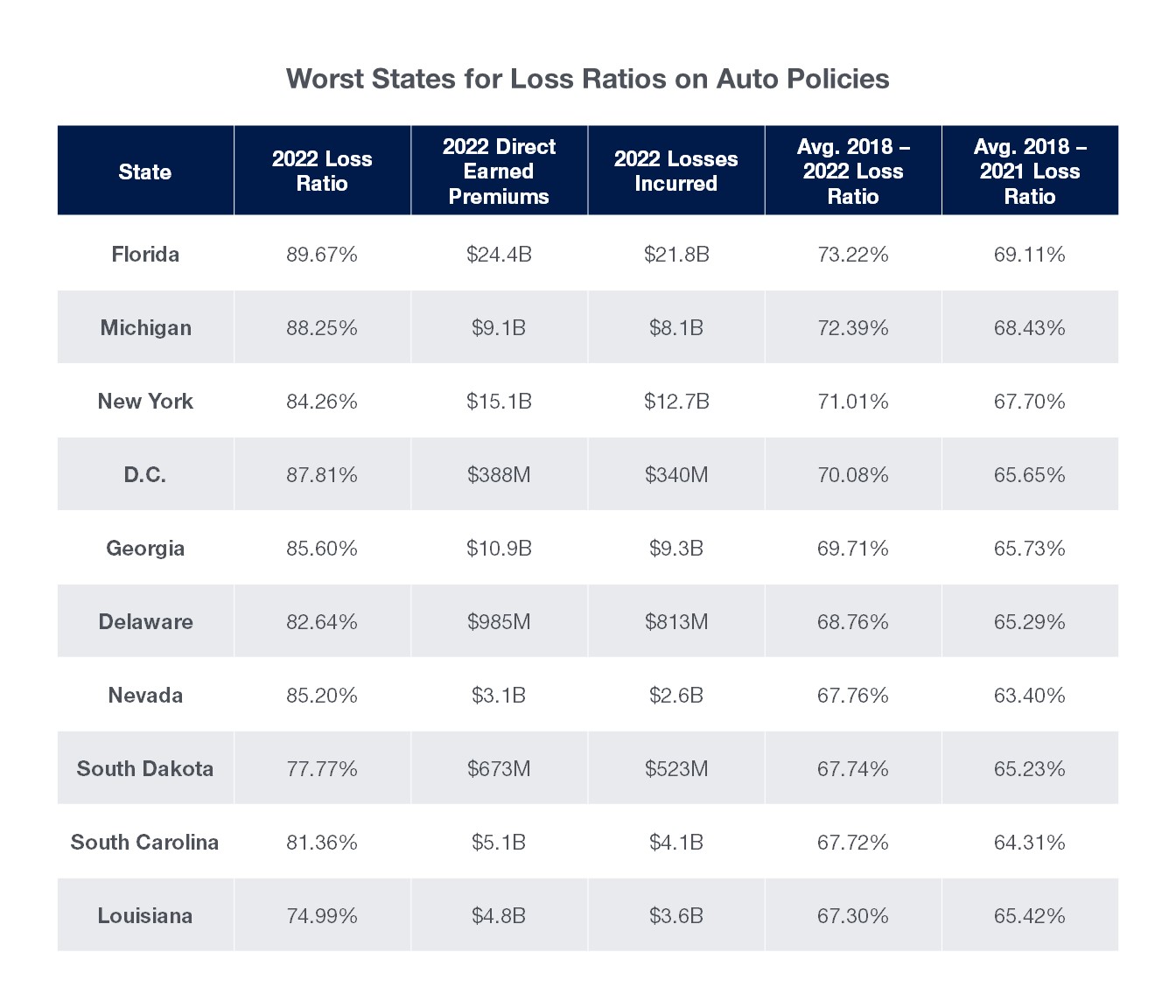

In addition to climate risks, automobile coverage is continuing to get worse. If you live in one of the states below, you should expect larger than normal rate increases. Cost of material, hourly labor charges, and higher judgments have all contributed to higher premiums.

Worst States For Loss Ratios on Auto Policies

Source: S&P Global

Summary

As 2024 begins, clients can expect premium increases, though not to the level they have been in the past several years. Keep in mind that predicting where rates are going is like predicting where the S&P is headed 12 months from now, or what the temperature will be in 30 days. Many market factors impact rates, and a mix of art and science is involved in making any prediction. After discussion with our industry experts, we believe the following rate increases are within reason and should be expected.

For a more in-depth discussion of what lies ahead, and how best to be certain that you and your assets are covered, contact your Hilb Group professional today.

Sources

- “2024 Global Insurance Outlook: Deloitte Insights”

- “A Return to Balance: Brokers Say Reinsurance Renewals Were ‘Stable’,” Insurance Journal, January 22, 2024

- “Best’s Market Segment Report: Market Segment Outlook: US Commercial Lines,” AM Best, December 5, 2023

- “Best’s Market Segment Report: Market Segment Outlook: US Personal Lines,” AM Best, December 4, 2023

- “Allstate is no longer offering new policies in California,” New York Times, June 4, 2023

- “Chubb pulling back sharply in California; CEO blames price inadequacy,” S&P Global Market Intelligence, October 27, 2021