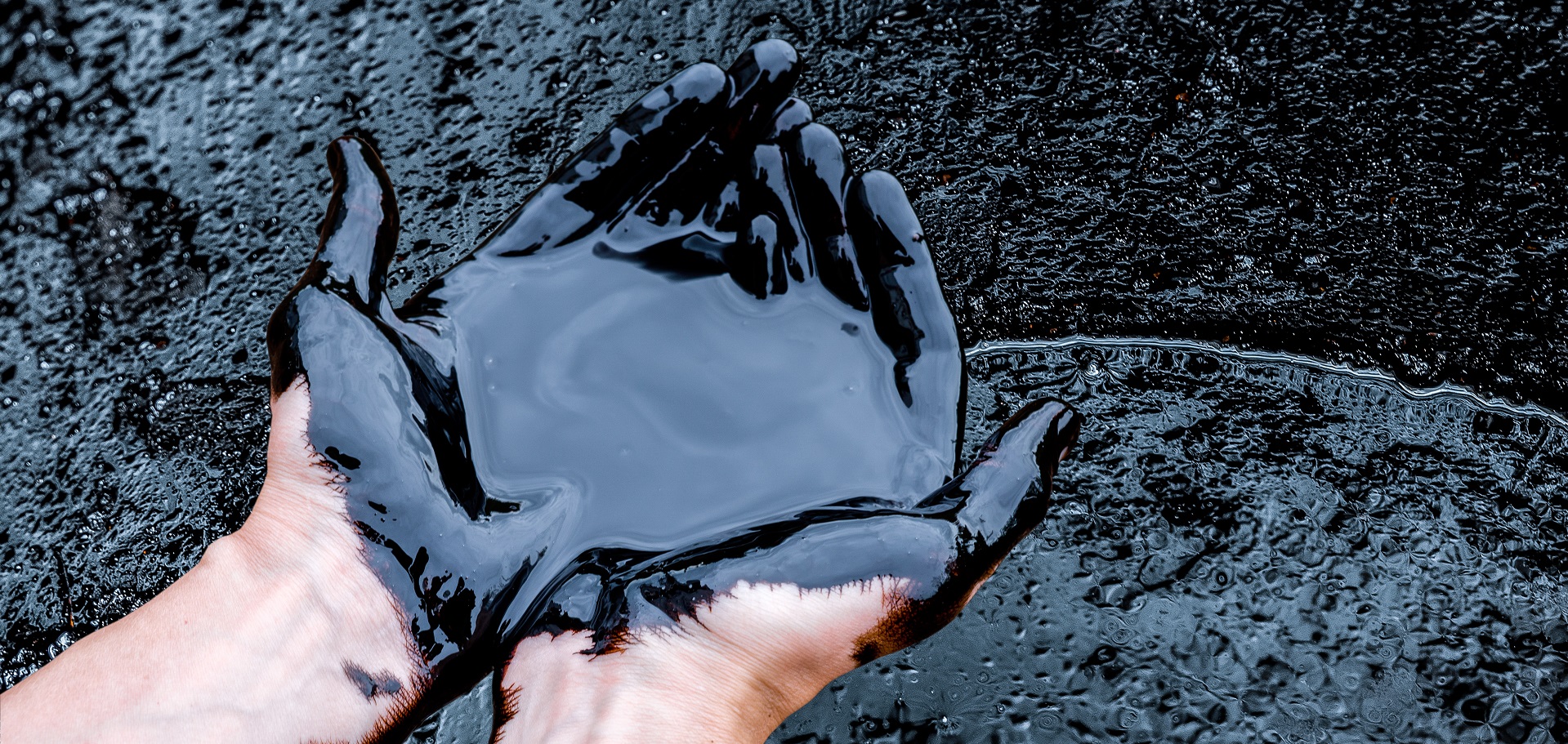

As a real estate attorney or a commercial real estate developer, you understand that environmental risks may not be just minor stumbling blocks. They can significantly shape the feasibility and success of a particular project. Even if you’ve done your due diligence, there’s always the risk that an unexpected discovery or incident could quickly grind progress to a halt. And with environmental accountability at the forefront of the public eye and government agendas, even a minor pollution event can trigger time-sensitive and costly regulatory compliance processes.

For instance, not so long ago a significant environmental liability incident negatively impacted a prominent New York city real estate developer. They faced considerable environmental challenges early in their massive redevelopment project. The soil and groundwater were contaminated with hazardous substances, including petroleum and heavy metals due to the site’s history as a railway yard and industrial area.

To tackle these issues, the developer undertook extensive remediation efforts, including soil excavation, groundwater treatment, and measures to prevent harmful vapors from impacting future buildings. These activities not only incurred substantial costs but also delayed the project and were covered extensively by local media, underscoring the critical importance of thorough environmental due diligence in real estate development.

But, even if you take every proactive measure, you can never be 100% certain you have resolved all pollution issues. There is, however, a way to mitigate these considerable risks. Pollution Liability (PL) insurance, sometimes referred to as Pollution Legal Liability (PLL) insurance, or Environmental Impairment Liability (EIL) insurance, can offer you a project-saving lifeline in these scenarios if you have been forward-thinking enough to protect yourself in advance.

So, how does it work? Here’s a quick overview.

Benefits of Pollution Legal Liability Insurance

Pollution Liability insurance (Environmental Liability insurance) is a commercial insurance specifically designed to cover environmental risks that are not typically included in traditional property and casualty policies. It offers numerous benefits to businesses, making it an essential component of a comprehensive risk management strategy. Key advantages include:

- Protection Against Unexpected Pollution Exposures and Environmental Accidents: As mentioned above, Pollution Legal Liability insurance provides comprehensive environmental coverage to property owners/operators, buyers, sellers, and developers to protect against for unforeseen pollution incidents, ensuring that businesses are not financially crippled by unexpected events. The coverage can also be extended to cover pollution caused by the transportation of waste or contaminated products, as well as events that occur at a disposal site not owned or run by you or your clients.

- Coverage for Cleanup Costs, Bodily Injury, Property Damage, and Legal Expenses: This insurance covers a wide range of expenses caused by different pollution conditions – environmental claims, injury claims, property damage, cleanup costs from remediation efforts to legal defense costs.

- Enhanced Reputation and Credibility: By demonstrating a commitment to environmental responsibility, businesses can enhance their reputation and credibility with stakeholders, including customers, investors, and regulators.

- Compliance with Regulatory Requirements and Industry Standards: Pollution Legal Liability insurance helps businesses comply with environmental regulations and industry standards, avoiding potential fines and legal issues.

- Customizable Coverage: Part of the benefit of PLL/EIL is its flexibility. The exact coverage can be tailored to your business’s specific needs to consider factors such as your location, local regulations, any tenancies or the type of environmental risks you hope to protect against.

- Ability to Qualify for Contracts and Loans: Many contracts and loans require businesses to have Environmental Impairment insurance, making it easier to secure new opportunities and financing.

- Business Interruption and Loss of Income Due to Environmental Accidents: Pollution Liability insurance can also cover business interruption and loss of income resulting from environmental accidents, ensuring that businesses can continue operations even in the face of significant disruptions.

Pollution Liability insurance can be purchased as a standalone policy or as an endorsement to a General Liability policy. The coverage is typically triggered by a pollution incident or environmental accident, with the policy responding to provide coverage for the resulting damages and expenses.

Who Is a Good Fit for PLL/Environmental Impairment Liability Insurance?

There are several key entities in the real estate or development sectors for whom PLL/EIL could be particularly beneficial:

Redevelopers – If you’ve landed a new big-box tenant who wants you to shoulder more of the environmental risk going forward, PLL/EIL can be quite handy. It acts as a safety net, ensuring unexpected environmental issues don’t curtail your project and eliminate your potential tenant’s desired new space.

Business Property Owners – If you’re sinking money into a new warehouse, manufacturing facility, or office building, the last thing you need is a pollution event halting your plans for growth. PLL/EIL can provide the safety net you need, so you can move forward with confidence.

Buyers – PLL/EIL can offer critical safeguards against the costs and legal hassles of certain hidden environmental issues that might emerge after acquisition.

Sellers – Selling a property can be complicated, especially with representations and warranties lingering after closing. Securing PLL/EIL can be a strategic move, mitigating your risk and advancing negotiations by providing protection for environmental issues discovered post-sale.

Prospective Borrowers – If you’re still looking to secure financing for a property or project, PLL/EIL can help you tell a more compelling story to prospective lenders.

In addition to environmental risks, businesses should also consider professional liability insurance to protect against client lawsuits related to unsatisfactory work.

In essence, PL/EIL is not just insurance; it’s a strategic tool for anyone involved in property development, ownership, sale, or financing. It safeguards your interests, finances, and projects from the unpredictable nature of environmental risks and the policies are assignable, adding to their value.

If you or a client of yours is in a situation where environmental surprises could possibly derail your plans, discussing PLL/EIL should be top of your to-do list. Although not uncommon, PLL/EIL coverages aren’t offered by every insurance company, and the intricacies can be pretty complex. Our strong relationships with specialized insurance carriers make us an ideal partner for navigating and identifying the right coverages for your specific project.

Choosing the Right Environmental Insurance Provider

Selecting the right environmental insurance provider is crucial for businesses to ensure they have adequate coverage for their environmental risks. When evaluating potential providers, businesses should consider the following factors:

- Experience and Expertise in Environmental Insurance: Choose a provider with a proven track record and expertise in environmental insurance to ensure they understand the unique risks and coverage needs of your industry.

- Range of Coverage Options and Policy Flexibility: Look for a provider that offers a wide range of coverage options and flexible policies that can be tailored to your specific needs.

- Financial Stability and Rating of the Insurance Company: Ensure the provider is financially stable and has a strong rating, indicating their ability to pay claims and provide reliable coverage.

- Claims Handling and Customer Service Reputation: Research the provider’s reputation for claims handling and customer service to ensure they will be responsive and supportive in the event of a claim.

- Ability to Provide Risk Management and Loss Control Services: Choose a provider that offers additional services, such as risk management and loss control, to help you proactively manage your environmental risks.

By carefully evaluating these factors, you can select an Environmental Liability insurance provider that meets your unique needs and provides comprehensive coverage for your environmental risks.

If you need coverage or just want to discuss the benefits of PLL/EIL in more detail, don’t hesitate to contact Scott D’Aloise at sdaloise@hilbgroup.com.