What we're seeing

What does this translate into for property market increases?

Based on market research and proprietary Hilb data, we expect 2023 to result in rate increases between flat and +15% for non-catastrophe good loss experience business. Property located in catastrophe-exposed locations will experience significantly higher rate increases and find limited competition in the market.

What was the impact of Hurricane Ian and other natural catastrophes?

Hurricane Ian, which struck Florida in September 2022, incurred $60 billion in insured losses — about half of the global total of $120 billion in property losses. According to Munich Re, Ian was the second all-time costliest hurricane after Katrina struck in 2005, adjusted for inflation.1 To put Ian into context, it is the second costliest U.S. natural catastrophe in terms of insured property losses — after Hurricane Katrina in 2005.

Top 10 Costliest Natural Catastrophes, United States

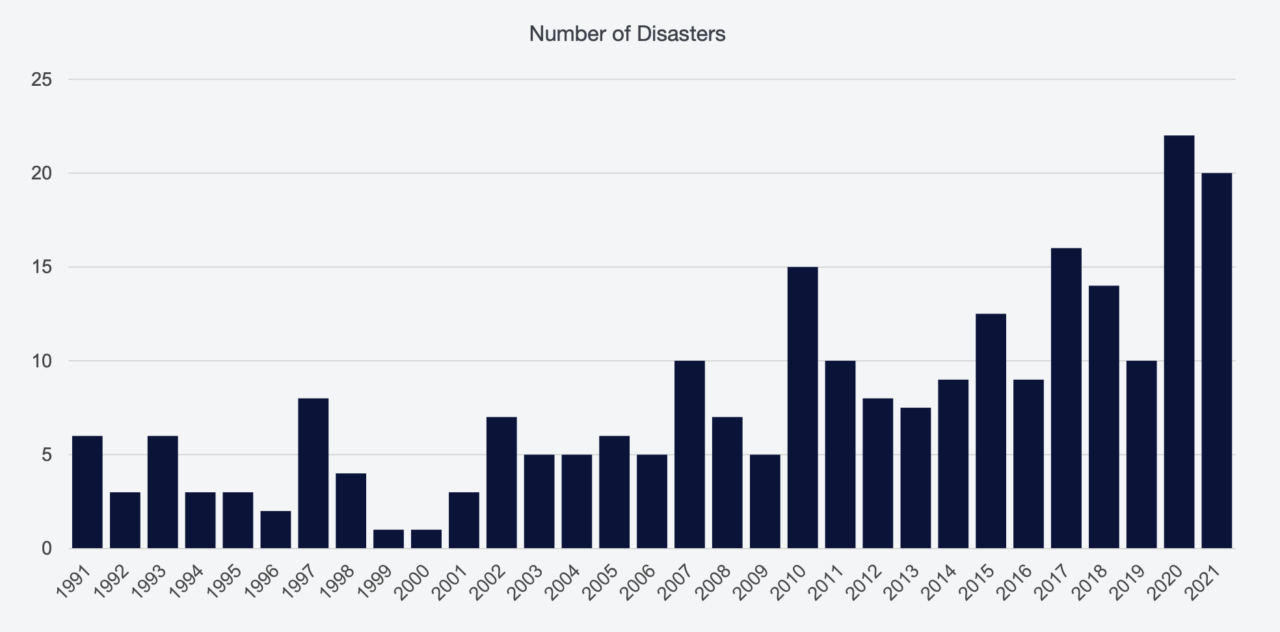

Natural catastrophes resulting in more than $1 billion in losses have increased in recent years. Since 2017, McKinsey notes that the U.S. has averaged 15 such natural catastrophes per year, compared to fewer than 10 in the previous decade.2 In 2022, 18 disasters exceeded the $1 billion loss mark, including Ian and two other hurricanes, three hailstorms, two tornado outbreaks, and several severe thunderstorm events.3

This data demonstrates that the weather events we are now experiencing are more frequent and more destructive than ever.

As these kinds of events occur, along with the repeated need for recovery, inflation and rebuilding costs continue to be a concern. Construction Dive reports that construction materials for building projects are 36% higher than pre-pandemic levels.4 This increase in construction materials has translated into higher insurance costs through increases in a building’s insured value. The cost to replace a building today is higher than several years ago. We encourage our clients to regularly review their insured value to be certain the amount of insurance matches the amount it will cost to replace your insured property (whether it is real property, contents, rent coverage, or otherwise).

Volume of disasters in the US with > $1 billion in damages since 1991 (adjusted for inflation)

January 1, 2023 Reinsurance Renewals: Impact on Insurance Rates

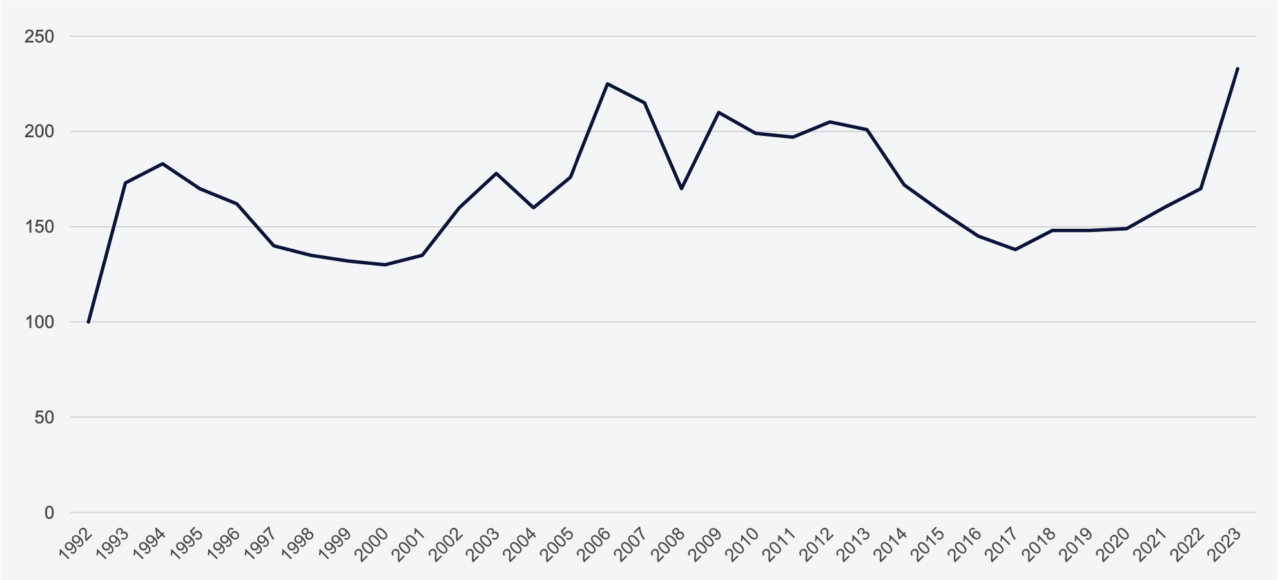

Mounting property losses in recent years, coupled with the $60 billion in losses from Hurricane Ian, contin- ued to harden the reinsurance market. According to reinsurance broker Howden, global property catastrophe reinsurance rates increased by 37%, the largest single year increase since 1992 (coincidently the same year as Hurricane Andrew – at its time, the worst insured event to date).5

S&P Global Ratings characterized the reinsurance market as “disciplined in holding its ground to achieve rate improvements given the lackluster performance and growing headwinds the sector is facing.” Additionally, Amwins, a leading wholesale property broker, indicates there has not been a significant influx of capital to drive competition and rates lower.6

Global Risk-Adjusted Property-Catastrophe Rate-on-Line Index - 1992 to 2023

The Effect on U.S. Commercial Property Insurance Rates

Higher reinsurance rates continue to drive higher rate increases. As referenced earlier, we expect rate increase in the range of 0-15% for good, non-catastrophe exposed risk. This level is consistent with the fourth quar- ter of 2022 (Q4 2022), during which commercial property premiums rose an average of 16%, based on data from the Council of Insurance Agents & Brokers. Q4 2022 continued the trend upward: 11.2% in Q3 2022 and 8.3% in Q2 2022.7

Ultimately, rate increases depend on the specific risk and the related loss history. Morgan Stanley recently published a report that highlighted REIT insurance costs are increasing for properties in Florida, as well as Texas, specifically the Houston market. For companies considering purchasing investment property in Florida, Texas, Louisiana, North Carolina, or South Carolina, buyers should be prepared for higher premiums than anticipated with higher deductibles for wind and hail damage. According to the Morgan Stanley report, REITs with newer buildings in their portfolios and/or features like smart sensors that can detect flooding have an advantage when it comes to insurance pricing.8

Mitigating Insurance Increases: What Can Be Done

Companies have a great opportunity to mitigate increases through a dedicated effort and focus on risk engineering. Properties that are run well and follow proven risk protections will be in a stronger position with underwriters to secure the best possible pricing. This includes ensuring repairs are taken care of promptly, maintenance agreements are up to date, any outstanding issues are brought up to code, systems are checked at regular intervals, and roofs are inspected before hurricane season. Discussing the issues with your Hilb Group broker well in advance of the renewal can help in mitigating potential increases.

“The number of catastrophes is continuing to rise, and that’s not going away. The best-run properties are going to be first in line for available capacity and good pricing. All elements — in terms of a risk engineering perspective and valuation perspective — have to be right, or carriers will blow by and go to the next in line.”

Debbie Dorsch, Hilb Group

Sources

1. Munich Re: Climate change and La Niña driving losses: the natural disaster figures for 2022

2. McKinsey: McKinsey Global Insurance Report 2023: Commercial P&C

3. National Oceanic and Atmospheric Administration: Billion-Dollar Weather and Climate Disasters

4. Construction Dive: Construction input prices log biggest drop since April 2020

5. Howden: Howden’s renewal report at 1.1.2023: The Great Realignment

6. Amwins: State of the Market Q1 2023

7. The Council of Insurance Agents & Brokers: Commercial Property/Casualty Market Index Q4 2022

8. Morgan Stanley: REITs | North America, What’s Going on in Florida?